UKWordWizard: Value-Added Tax (VAT)

Words Worldwide has supplied zero-rated software to people with disabilities since 1998 and has been instrumental in fighting for major concessions for the special needs community.

WordWizard was solely designed as an aid for people requiring special assistance in overcoming difficulties with developing literacy skills. As such it qualifies for zero-rating under HM Revenue & Customs (HMRC) regulations.

Are you eligible to purchase WordWizard at zero-rated VAT?

If your order is intended to assist with difficulties with literacy caused by a condition such as dyslexia we can supply the product zero-rated for VAT purposes. There will be no requirement for you to make any formal declaration to HMRC.

However, you need to complete a simple form to confirm with us that you are eligible to purchase at the zero rate of VAT. You can download a copy of the form by clicking on this link. Simply complete the document, sign it and email us a copy. If this causes any difficulty, you can put the wording into an email and send it to us.

If you have any doubt as to whether you are eligible for relief, click on this link to gain access to the HMRC document which fully describes the regulations. The document is Reliefs from VAT (VAT Notice 701/7).

VAT reliefs for disabled people are not means-tested. They are not dependent on the benefits a disabled person may or may not get and a person does not have to be registered disabled in order to qualify.

We can only zero rate supplies to disabled people when the person is ‘chronically sick or disabled’ and the purchase must be for the personal or domestic use of the customer.

HMRC consider that a person is ‘chronically sick or disabled’ if they are a person with :

- a physical or mental impairment which has a long-term and substantial adverse effect on their ability to carry out everyday activities

- a condition which the medical profession treats as a chronic sickness, such as diabetes

It does not include an elderly person who is not disabled or chronically sick or any person who’s only temporarily disabled or incapacitated, such as with a broken limb.

If a parent, spouse or guardian acts on behalf of a ‘chronically sick or disabled’ person, your supply is treated as being made to that ‘chronically sick or disabled’ person.

‘Domestic or personal use’ means that the supply is needed specifically for the use of a disabled individual or series of disabled individuals.

If you need further information or confirmation of the information given above then click on the link below which will take you to the relevant section of the HMRC web site: https://www.gov.uk/government/organisations/hm-revenue-

customs/contact/vat-enquiries

How do I purchase at the zero rate of VAT?

Zero rating works by Words Worldwide not charging you VAT. It is as simple as that.

You simply need to confirm when you order WordWizard that it is intended to address dyslexia or any other specific condition (as described above) and pay the purchase price, without adding VAT.

To allow us to supply at the zero rate of VAT we need to provide you with a hard copy of the WordWizard software after you make your purchase. This will be sent by second-class surface mail. You may still download the 30-day trial version of the program and obtain the licence key for the permanent licence online in the normal way.

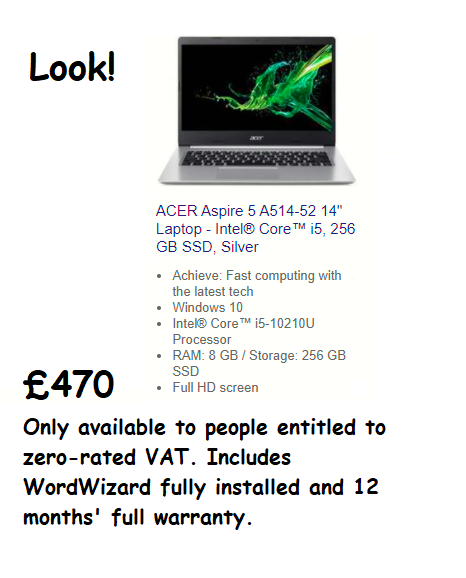

The supply of a complete workstation at zero-rated VAT

Assistive technology involves the pre-installation of specialist software which is specifically required by the disabled individual. Where such a purchase is made, the complete system will be defined as designed solely for use by that disabled person, and will be eligible for the relief.

Assistive technology involves the pre-installation of specialist software which is specifically required by the disabled individual. Where such a purchase is made, the complete system will be defined as designed solely for use by that disabled person, and will be eligible for the relief.

We are able to supply a complete workstation with WordWizard installed and ready to use. The entire cost of the computer system and any additional zero-rated software is then zero-rated, provided we

receive a valid eligibility declaration from you. Other software which is not zero-rated and is loaded onto the machine will be eligible to zero-rated VAT provided that it is essential to meet the requirements of the user.

We are able to supply other products designed for people with disabilities at favourable purchase prices and zero-rated VAT. Please email us to find out more about this service.

If you intend to purchase a new machine and are also considering purchasing WordWizard please contact us immediately to see how we can help reduce your costs. Simply email: enquiries@wordsworldwide.co.uk

If you purchase a computer and pay VAT and then load zero-rated software you may still be able to claim back the VAT but the process is not straightforward and relies on the provider of the goods to cooperate with you.

Any further support services directly related to maintaining or repairing the computer are also eligible for VAT relief.

Disabled Student’s Allowance (DSA)

There is no need to get such a declaration from a disabled customer who’s buying eligible goods or services funded by the Disabled Student’s Allowance (DSA). This is because only eligible persons are

entitled to DSA. Keep evidence that the goods or services were funded by DSA.

Purchase of WordWizard by customers who are not eligible for zero-rated VAT

Although WordWizard was specifically and exclusively designed for use by people with literacy difficulties caused by conditions such as dyslexia, the program is available for purchase by others. However, VAT will then be due at the normal rate of 20%.